Payments

Trusted online merchant services

Merchant payment gateway and merchant accounts - SecurePay is a flexible and secure internet merchant account provider 1.

Merchant payment gateway and internet merchant account pricing

A straightforward per-transaction pricing model for a combination of an online merchant account and payment gateway service.

Standard

1.6% +

$0.30 AUD

Domestic cards

3.4% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners or Apple Pay

Standard $25 chargeback fee

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Your multi functional online merchant account

Take payments online, view detailed reports and access local support. For a trusted local online merchant service, look no further.

SecurePay’s online merchant services

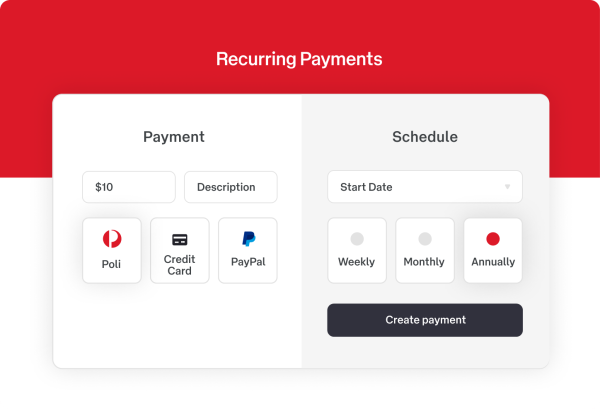

When you use SecurePay’s internet merchant account, you automatically have access to the merchant payment gateway, direct debit services and recurring payment solutions.

Ready to start with SecurePay’s internet merchant account?

What is a merchant account?

A merchant account is a special type of bank account, specifically designed for vendors who want to accept credit and debit cards. The account holds the proceeds from the payment processing of credit cards. A merchant account is an agreement between a retailer, a merchant bank and payment processor for the settlement of card transactions.

What is an internet merchant account?

An internet merchant account is a vital component of any e-commerce operation. You must have access to an online merchant account if you want to use a payment gateway to process transactions from your website.

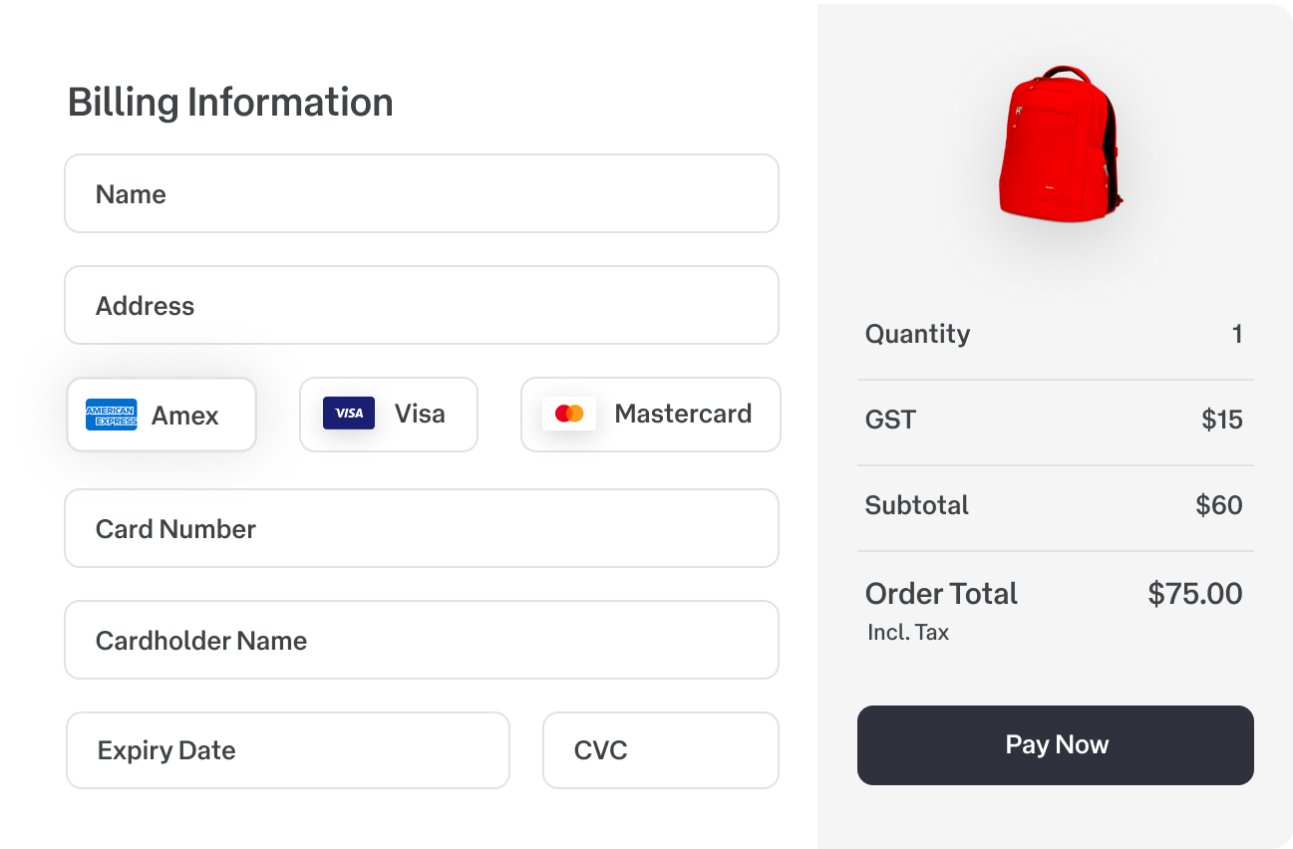

Merchant accounts are often confused with payment gateways. To take payments online you need both a payment gateway and a merchant account, but they are not the same. While a payment gateway authenticates the submitted credit card information (the same as a handheld point of sale machine does in a traditional bricks and mortar establishment), a merchant account is used to hold the funds until the transaction is approved.

How online merchant services work

When a customer pays you online for a product or service with a card, the funds are first deposited into the merchant account where they are temporarily held. From there the funds are eventually transferred to your business bank account. You won’t have direct access to deposit or withdraw funds form the merchant account. Instead, it’ll be managed entirely by the bank or by your payment services provider.

An internet merchant account is cleared of its balance at regular intervals. This clearing process is known as ‘settlement’. Settlements are normally done on a daily or weekly basis. However, in some cases, the speed and regularity of settlement could be dictated by the perceived risk in your business. The riskier the business the slower settlement will be.

Online merchant facility through your bank or payment service provider?

Merchant accounts can typically be opened with large banks that provide such services via sister companies. However, you do not have to use any online merchant service recommended by your bank.

Apart from banks, many companies, including some payment processors and most payment gateway providers, offer merchant accounts. In all cases, to acquire a merchant account, you must have some sort of arrangement with a payment processor to charge a customer’s card.

Banks often have stricter requirements and greater reluctance to service smaller merchants or higher risk business plans. Indeed, they will often take more time to review your application, thereby lengthening your time to market. A payment service provider, who is more specialised than a bank, can use its expertise and banking relationships to get you an internet merchant account quickly.

A product of Australia Post - SecurePay is an online payment gateway and payment service provider. SecurePay offers merchant services, including internet payment solutions, direct debit systems and recurring billing.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.